This will be the “scar” that the strategy against the pandemic will leave in Mexico, warns Moody’s

Fiscal austerity is beneficial for short – term finance of the country; Among some of the benefits it has are the fact that Mexico will not have to reduce the size of the government in the midst of the pandemic (cuts), it also limits the increase in debt and mitigates the degree to which the quality of sovereign credit could deteriorate.

Thus, Mexico closed last year with a fiscal deficit of 4.1 percent of GDP, which is equivalent to less than half of the Latin American median, which stood at 8.6 percent.

All of the above provides the country with a certain credit value, as estimated by the brokerage Moody’s Investor Services in an analysis called “Government of Mexico. Frequently asked questions about the trajectory of sovereign credit amid weak growth, prospects, fiscal austerity, and support for Pemex ”.

Another benefit is the fact that by 2021, the country’s debt burden would be less than that of other similar nations, which would provide some “oxygen” at critical times such as those experienced by the world’s economy.

However, in the context of the pandemic, the fiscal austerity that has characterized the current administration triggered a response that provides liquidity and limited income support for businesses and households, as little was done to offset the economic impact of the pandemic.

In the absence of government support, income and employment levels have deteriorated, small businesses face real risks of a shutdown, and all of the above will hamper domestic demand and the economy’s ability to recover faster.

Moody’s warns that the government’s economic strategy to the pandemic and its effects will potentially leave a ” lasting scar ” on the country’s economic strength.

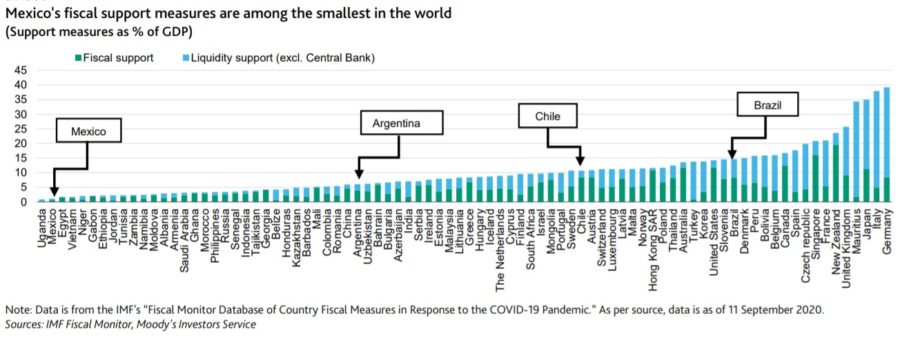

It turns out that Mexico’s response is one of the least “aggressive” in the world; The measures it implemented represent only 1.1 percent of GDP, which represents a percentage close to that of Uganda whose measures are equivalent to only 0.8 percent of GDP, this response is also lower than 1.7 percent of Egypt.

In contrast, other emerging Latin American nations opted for fiscal responses with much higher magnitudes, notably the cases of Chile, Peru and Colombia, whose fiscal measures represented levels between 5.3 and up to 10.7 percent of their GDP, with measures such as direct injection of liquidity, credit guarantees, tax deferral, and greater public investment to support domestic demand.

As a consequence, relative to other Latin American and emerging market countries of the G20, the country’s recovery will be one of the weakest and lagging behind; It is estimated that nations such as Russia, Peru, Brazil, South Africa, China, Turkey, India, Saudi Arabia, Chile and Colombia will reach the production levels recorded in 2019 by 2022, Mexico will not.

The “lasting scar” consists in the fact that fiscal austerity is in fact relatively beneficial to the country’s finances because it provides some room for maneuver and places the country as one of the countries that must make the least adjustments in public finances. However, it leaves its real economy exposed to an uncertain and prolonged recovery, while condemning the country to a slow recovery, not without additional risks.

Mexico’s commitment to its economic strategy in the face of the pandemic is exactly the opposite of what practically the whole world made, that is injection of resources directly into the production plant, fiscal relaxation consisting of measures such as tax deferral, reduction of taxes. The same or a combination of credit support schemes, plus another series of measures that have been deployed over the months. Mexico only bet on fiscal austerity.

Public debt will continue to increase

This fiscal austerity will not prevent the country’s public debt from rising and eventually reduce the scope for action for the tax authorities in matters of public finances.

Moody’s Investor Services estimates that federal debt will increase 7.5 percentage points of GDP in 2020 compared to 2019, although it recognizes that this rate compares favorably with the Latin American average, which stands at 13.5 percentage points, but is explained precisely by the lower fiscal response to the pandemic.

Therefore, Mexico will have a higher interest burden in relation to 2019; Together with the large economic contraction, the effect of strong depreciation of the peso were the main drivers of the increase in debt.

The phenomenon will not stop in the years 2021 and 2022 despite the maintenance of fiscal austerity; Moody’s expects debt to grow at a relatively modest rate of 3 percentage points per year, driven by a primary deficit and an interest burden of 2.4 percent of GDP each year, despite the lower interest rate environment.

In addition, under the baseline scenario used by the rating agency, a cumulative increase of 15 percentage points is expected for 2023, with which debt as a percentage of GDP would stand at 51.4 percent from the 36.4 percent registered in 2019.

But if the coronavirus outbreak worsens, dampens prospects for economic growth and the government faces mounting social pressure to increase spending, even modestly, debt could reach 56 percent of GDP by 2023.

In another scenario, if we assume that the government will support Pemex and increase its capital spending by up to 10 billion pesos to increase production in a sustained manner, in addition to the liquidity and debt payment support that it provides to the oil company, then, government debt could rise to 59 percent of GDP by 2023.

Source: altonivel.com.mx